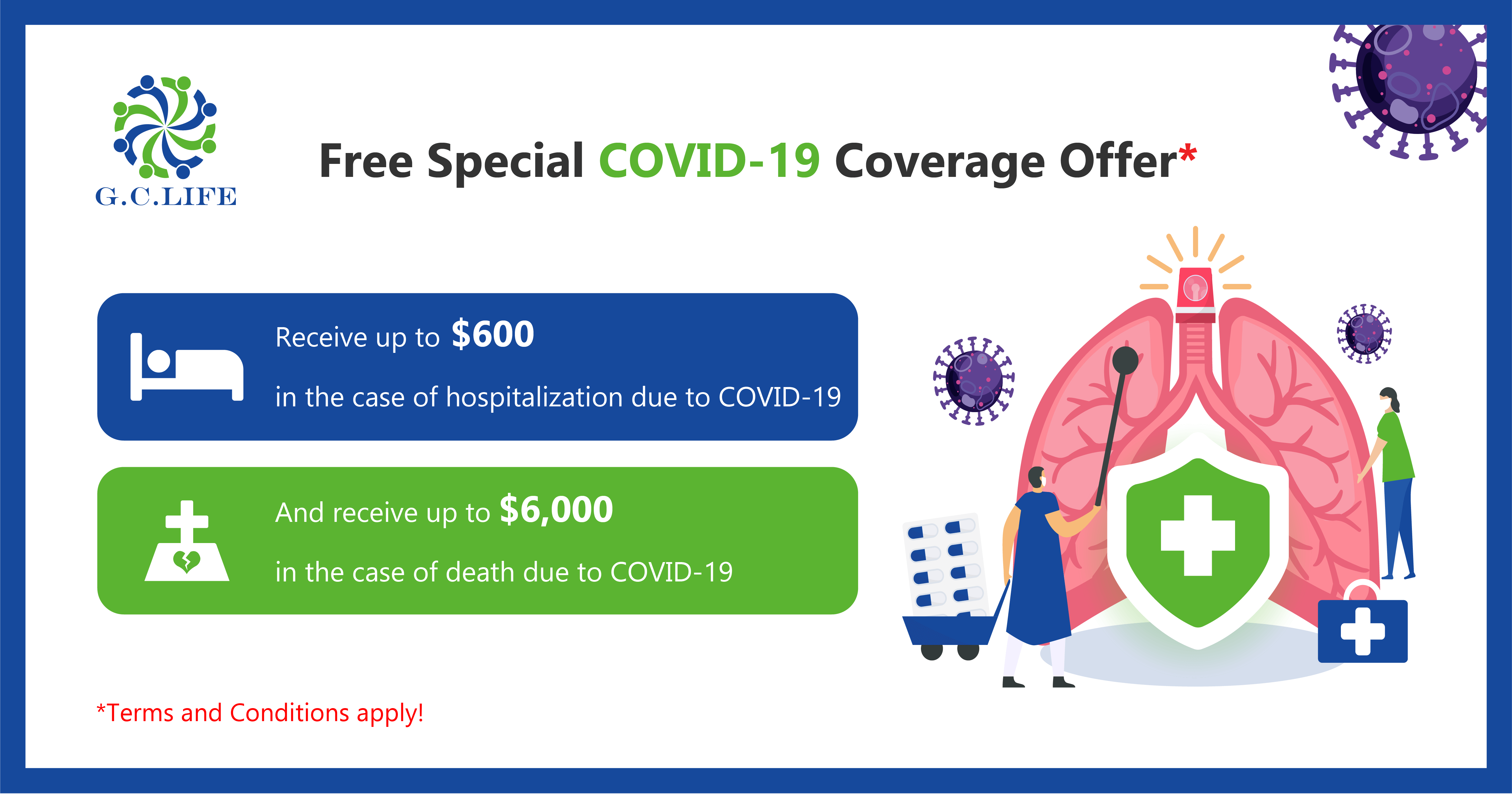

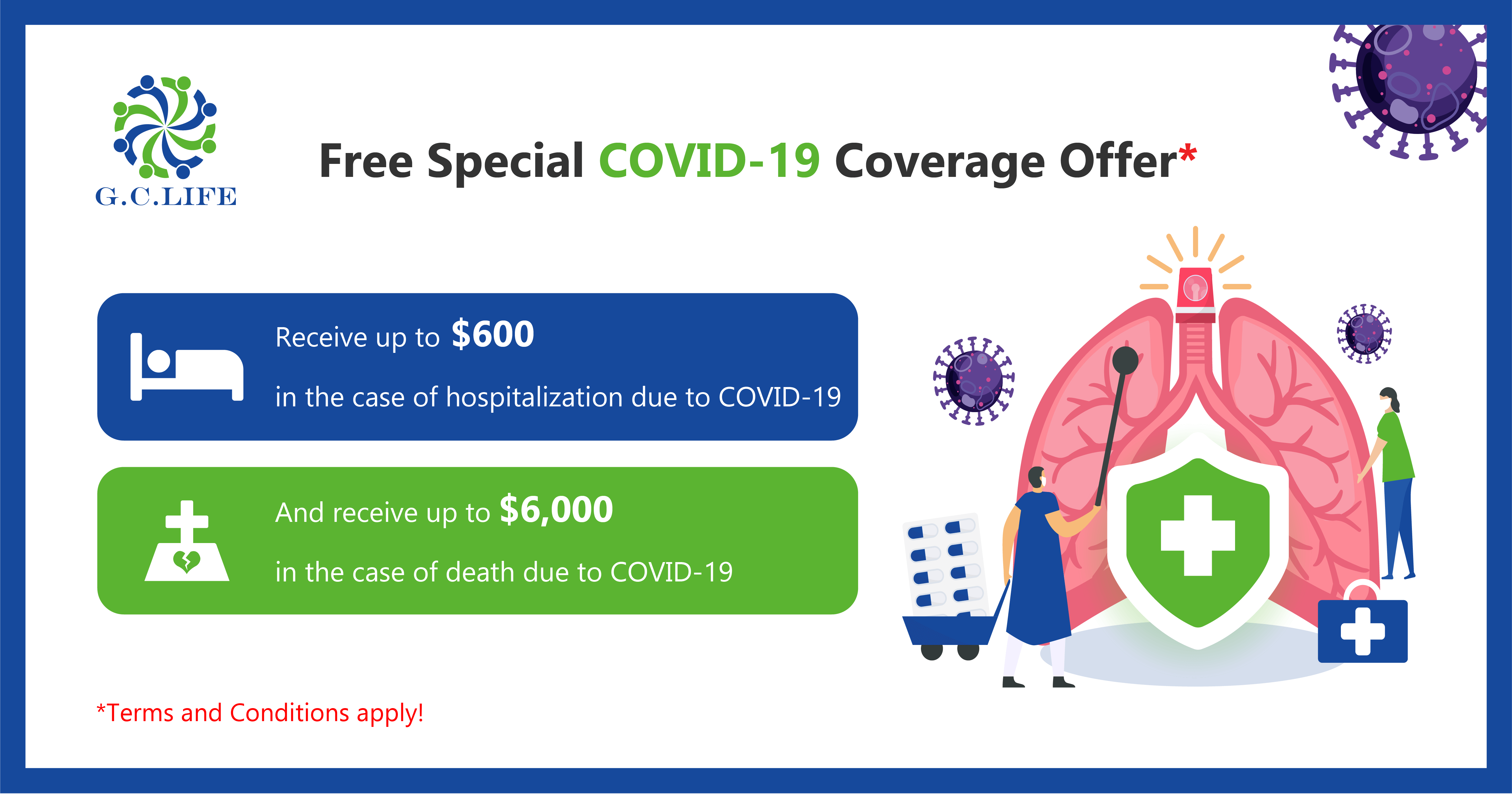

Special COVID-19 Coverage Offer For 2021 (Extension Update)

Details on Special COVID-19 Coverage* are as follows:

1. Period of Offer: new policies issued between 1st July 2021 to 30th September 2021

2. Period of Coverage: from 1st July 2021 until 31st December 2021

3. Applicable Products: all new and existing products, except 1-year term individual products

4. Waiting Period: 14 days starting from the policy issuance date applicable to all new policies issued from 27th July 2021 until the end of the Period of Offer.

5. Premium: no additional charge

6. Eligibility: Insured with policies issued within the Period of Offer and existing policies in-force for applicable products as at 30th June 2021.

7. Benefits:

• Applicable to Individual Policies:

a) Cash allowance of US$600 is payable after being discharged from the hospital, treatment center, or approved home treatment due to COVID-19.

b) Additional death benefit of 60% of the total Sum Insured (Death Due to Illness) or US$6,000, whichever is lower, is payable due to COVID-19.

• Applicable to Group Policies:

a) Cash allowance of 10 days hospitalization allowance or US$300, whichever is lower, is payable after being discharged from the hospital, treatment center or approved home treatment due to COVID- 19. This is only applicable for group policies with Accidental Injury Hospitalization Allowance Group Rider attached.

b) Additional death benefit of 60% of the total Sum Insured (Death Due to Illness) or US$6,000, whichever is lower, is payable due to COVID-19.

*Terms and Conditions:

1. This special COVID-19 coverage benefit is a one-time payment per Insured regardless of the number of in-force policies. In case the Insured has more than one (1) policy, the policy with the highest amount of benefit shall be payable.

2. In order to be eligible for this special COVID-19 coverage, the Policy must be in-force at the time of diagnosis.

3. This special COVID-19 coverage is only applicable for COVID-19 diagnoses within Cambodia during the Period of Coverage and after passing the Waiting Period with supporting documents issued by the Ministry of Health (MoH) and/or relevant authorities in Cambodia.

4. This special COVID-19 coverage will be deemed invalid in the case that the Insured defies the government ban for traveling or visiting a specific area of Cambodia which is restricted due to a COVID-19 outbreak.

5. This special COVID-19 coverage is not applicable to any Insured who have been diagnosed with COVID-19 prior to the submission of the insurance application/reinstatement request to GC Life.

6. No additional document or endorsement to the insurance contract shall be issued to customers for this special COVID-19 coverage.

7. Within thirty (30) days after being discharged from the hospital, treatment center, approved home treatment or death due to COVID-19, the Insured or Insured’s legal representative shall notify GC Life and submit a claim application together with supporting documents including but not limited to the COVID-19 positive test result, evidence of hospitalization/home treatment or death certificate due to COVID-19 (whichever applicable) issued by the MoH and/or relevant authority.

8. GC Life reserves the right to amend these Terms and Conditions at the Company’s sole discretion without any prior notice.