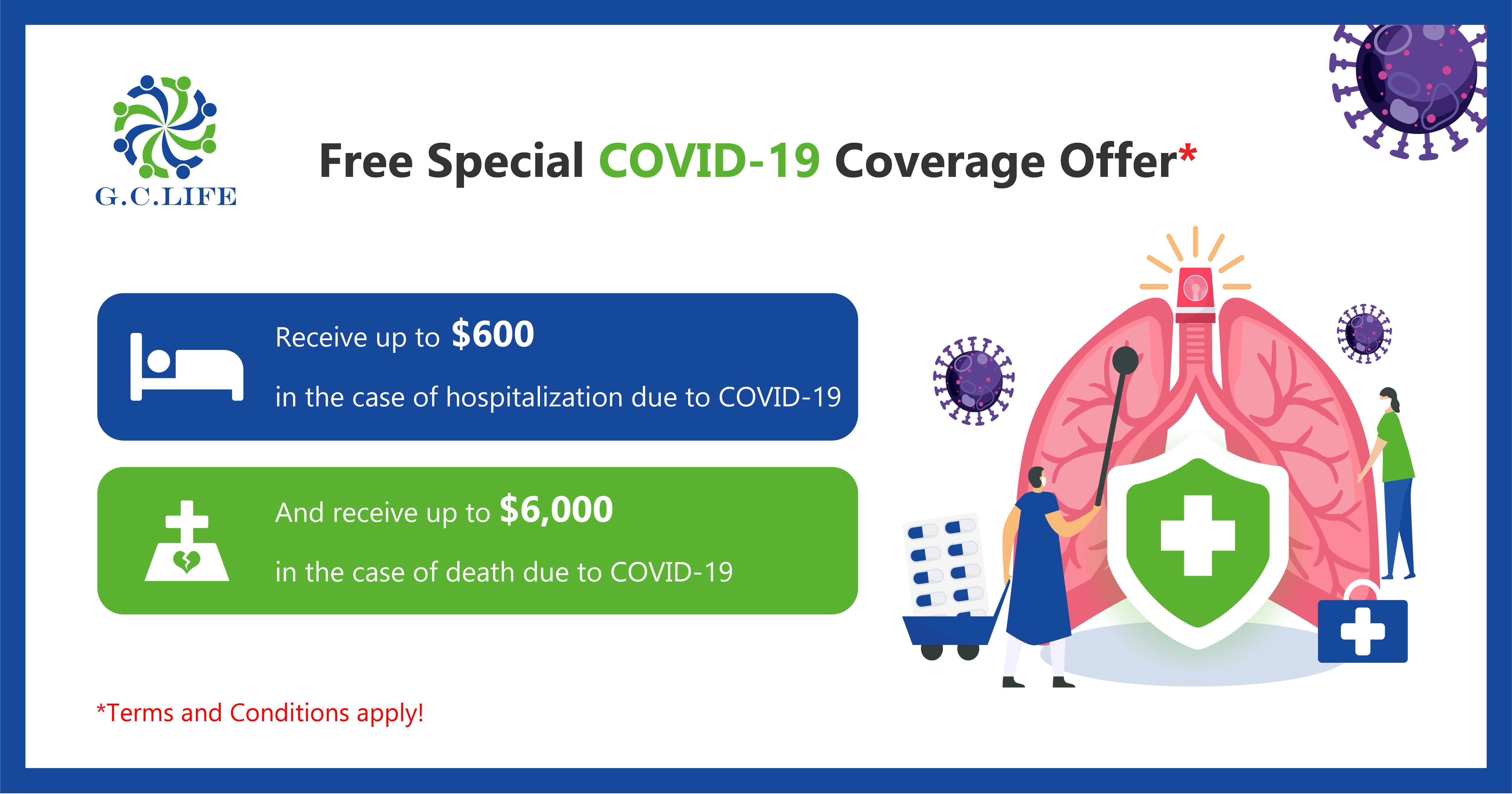

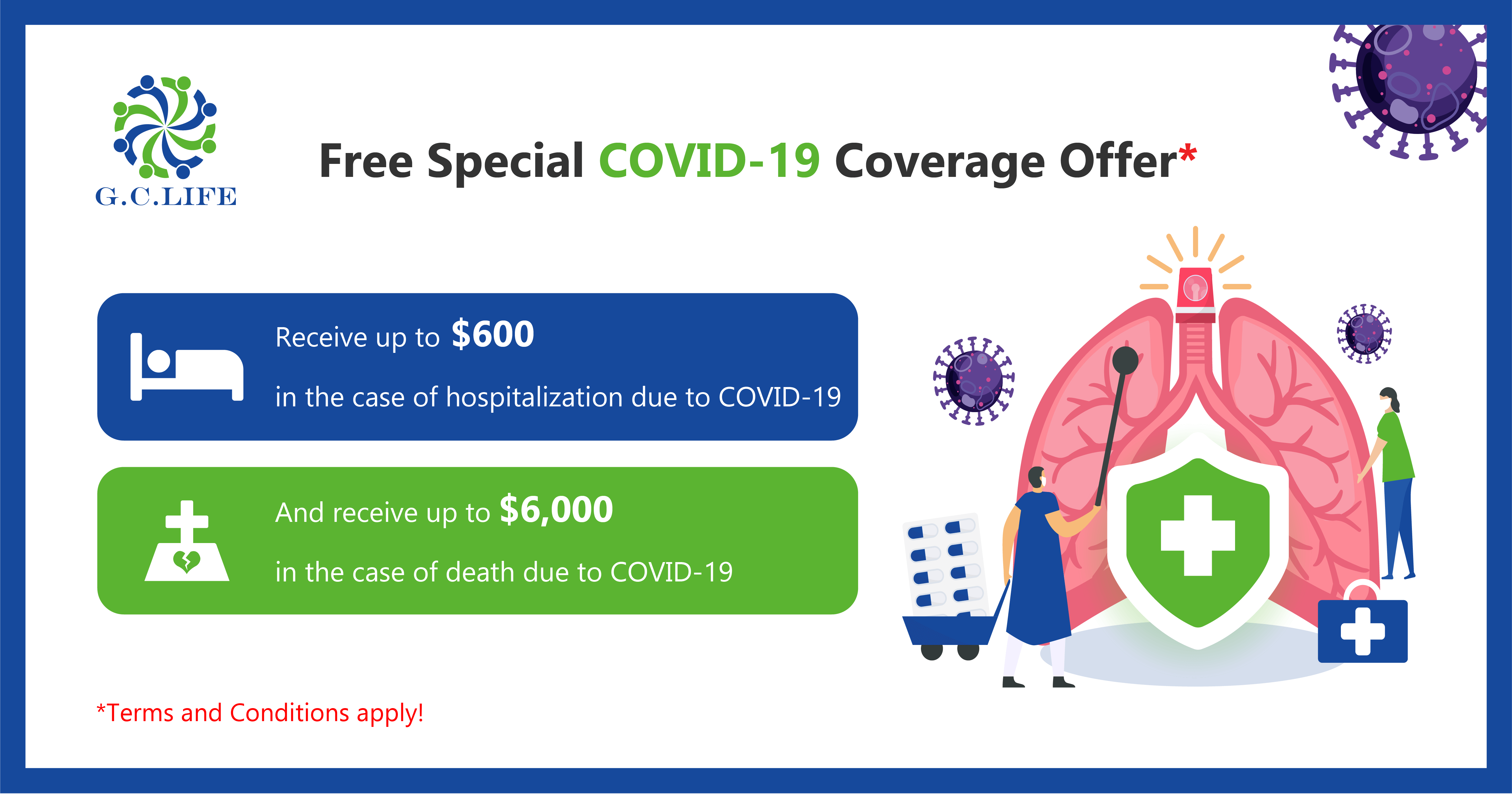

Special COVID-19 Coverage Offer For 2021

Details on Special COVID-19 Coverage* are as follows:

1. Period of Offer: new policies issued between 1st January 2021 to 31st March 2021

2. Period of Coverage: from 1st January 2021 until 30th June 2021

3. Applicable Products: all new and existing products, except 1-year term individual products

4. Premium: no additional charge

5. Eligibility: Insured with policies issued within the Period of Offer and existing policies in-force as at 31st December 2020.

6. Benefits:

• Applicable to Individual Policies:

a) Cash allowance of US$600 is payable after being discharged from the hospital due to COVID-19.

b) Additional death benefit of 60% of the total Sum Insured (Death Due to Illness) or US$6,000, whichever is lower, is payable due to COVID-19.

• Applicable to Group Policies:

a) Cash allowance of 10 days hospitalization allowance or US$300, whichever is lower, is payable after being discharged from the hospital due to COVID- 19. This is only applicable for group policies with Accidental Injury Hospitalization Allowance Group Rider attached.

b) Additional death benefit of 60% of the total Sum Insured (Death Due to Illness) or US$3,000, whichever is lower, is payable due to COVID-19.

*Terms and Conditions:

1. This special COVID-19 coverage benefit is a one-time payment per Insured.

2. In order to be eligible for this special COVID-19 coverage, the Policy must be in-force at the time of diagnosis.

3. This special COVID-19 coverage is only applicable for COVID-19 diagnoses within Cambodia during the Period of Coverage and must be confirmed by the Ministry of Health (MOH) of Cambodia with proper supporting documents.

4. This special COVID-19 coverage will be deemed invalid in the case that the Insured defies the government ban for traveling or visiting a specific area of Cambodia which is restricted due to a COVID-19 outbreak.

5. This special COVID-19 coverage is not applicable to any Insured who have been diagnosed with COVID-19 prior to the submission of the insurance application/reinstatement request to GC Life.

6. No additional document or endorsement to the insurance contract shall be issued to customers for this special COVID-19 coverage.

7. Within thirty (30) days after being discharged from the hospital or death due to COVID-19, the Insured or Insured’s legal representative shall notify GC Life and submit a claim application together with the proof of such claim including but not limited to the COVID-19 positive test result, evidence of hospitalization or death certificate due to COVID-19 (whichever applicable) certified by the MOH.

8. GC Life reserves the right to amend these Terms and Conditions at the Company’s sole discretion without any prior notice.